Malaysia accelerates e-Invoicing implementation post 2024 budget announcement

In the wake of the 2024 budget release, the adoption of electronic invoicing system (e-Invoicing) emerges as a top national priority.

LHDN's strategic move: e-Invoicing policy to roll out in 2024

The Inland Revenue Board (LHDN) is set to spearhead the e-Invoicing implementation in 2024. Initial implementation targets companies with an annual turnover exceeding RM 100 million, propelling Malaysia into the era of electronic invoicing.

Understanding e-Invoicing: a digital transformation

E-Invoicing, or electronic invoicing, refers to the electronic issuance, collection, and storage of receipts and payment vouchers in various business transactions. The Malaysian government is set to fully implement this system, progressively phasing out traditional paper or electronic documents such as invoices, return vouchers, fee vouchers, and more.

E-Invoices mirror their traditional counterparts, featuring essential details such as buyer and seller information, transaction specifics, etc. The distinction lies in the electronic storage of all transaction records within LHDNM.

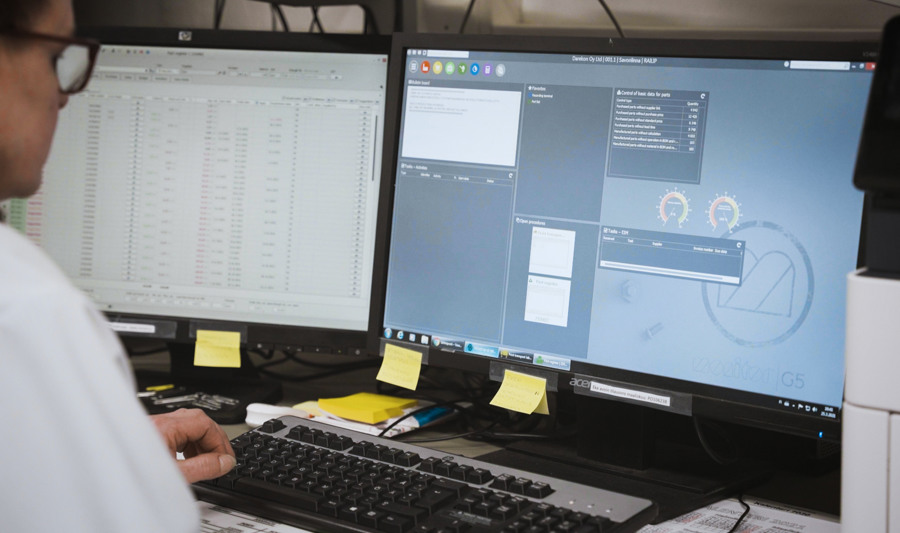

Implementing e-Invoicing with Monitor ERP

In 2024, our customers began implementing e-Invoicing through our local direct API (Application Programming Interface) integrated with the LHDN MyInvois Portal—eliminating the need for middleware. Monitor’s direct API enables a smooth, secure, and compliant e-Invoicing process, helping businesses streamline invoicing, improve accuracy, and meet regulatory requirements.

As of April 2025, Monitor ERP is officially accredited as a Peppol-Ready Solution Provider by the Malaysia Digital Economy Corporation (MDEC). This recognition affirms that Monitor ERP meets the regulatory and technical standards under the Peppol framework—enabling Malaysian businesses to adopt e-Invoicing with confidence and align with the country’s broader digital transformation goals.

We remain committed to supporting our customers’ transition to e-Invoicing through seamless integration, continuous updates, and dedicated assistance throughout the process.

Insights and preparation steps for a seamless e-Invoicing implementation

Key insights from Monitor:

When will e-Invoicing be implemented?

The phased implementation of e-Invoicing, mandatory for businesses based on their turnover, has witnessed an extension for larger enterprises. Taxpayers with an annual income exceeding RM 100 million now have until August 1, 2024, to officially start the implementation.

According to the October 13, 2023 budget, the implementation date for all other businesses has been advanced by 18 months. The original date of 2027's 1st month is now rescheduled to July 1, 2025.

Timeline of e-Invoicing implementation from Monitor

- 1st August 2024: Launched e-Invoicing functionality for customers, marking the first successful Go-Live with Monitor’s direct API.

- 1st January 2025: Expanding e-Invoicing support to more customers, enabling broader adoption and seamless integration across various sectors.

Costs

- Monitor e-Invoicing implementation cost: An initial cost may apply if training is required for implementing Monitor e-invoicing within the existing Monitor ERP system.

Phased implementation summary

- August 2024: For Monitor customers/taxpayers with an annual turnover exceeding MYR 100 million.

- January 2025: For Monitor customers/taxpayers with an annual turnover between MYR 25 million and MYR 100 million.

- February 2025: End of the 6-month soft landing phase for the first wave of large taxpayers from August 2024.

- July 2025: Mandatory e-Invoicing for all other taxpayers.

Mandatory education for enterprises

- E-Invoicing is now a mandatory course for every enterprise/taxpayer. Connect with the Monitor sales team to learn about the details of this system in advance of the official implementation dates outlined.

Source: Malaysia Digital Economy Corporation. (n.d.). National e-Invoicing Initiative. Retrieved from https://mdec.my/national-einvoicing